Panel Discusses Challenges and Opportunities of Socially Responsible Investing

MIDDLEBURY, Vt. — Middlebury continued its ongoing discussion about policies related to the College’s endowment Monday night when a panel of experts took up the subject of socially responsible investing.

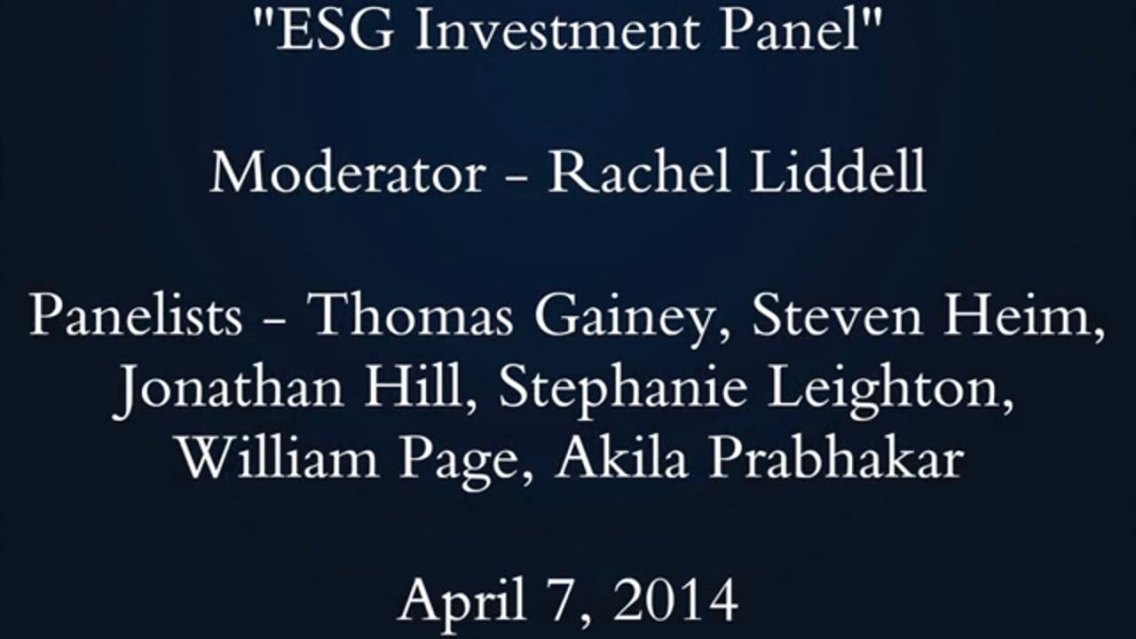

The panel, moderated by Student Government Association President Rachel Liddell ‘15, included six investment experts and focused on how institutions can incorporate an Environmental-Social-Governance (ESG) framework in their investment-selection process and how professionals evaluate fossil-fuel investments in educational and foundation endowments.

“The benefit of this whole strategy is that companies are starting to respond to the inquiries that people on this panel are making with the kind of information that’s important to us on these environmental, social, and corporate governance factors,” said Tom Gainey, vice president at Pax World Investments. “This has been increasing over time, and it is a reflection of the fact that we’re having some influence over corporate behavior over the long run.”

Over the past three years, Middlebury’s endowment assets allocated to ESG investments, and managers practicing ESG policies, has increased to 7.1 percent, said panelist Jon Hill, of Investure, which manages the College’s endowment.

“Increasingly ESG is not just a badge of good corporate citizenship, but a badge of good management,” said Hill.

Trillium Asset Management partner and portfolio manager Stephanie Leighton said her firm is seeing less of the avoidance approach that characterized divestment from South Africa in the 1980s. “The real trend in the last few years, especially from young people, is to seek out positive investments,” she said. “So we spend a lot of time trying to find the leading edge companies, and when we find the leaders, we ask the followers to adopt the policies of the leaders.”

Leighton also noted a dramatic increase in shareholder interest in ESG issues over the past few decades. “Twenty to 30 years ago, five percent of shareholders were showing interest in social and environmental issues. Now we get 50 percent and more, sometimes, of investors of all stripes thinking about these social and environmental issues.”

Panelists spoke about the complexity and approaches of evaluating and, in some cases, divesting from, fossil fuel companies.

“We’re money managers trying to solve the fossil fuel divestment conundrum by investing in technologies that will accelerate the move from fossil fuels to new energy resource scarcity technologies,” said William Page, senior vice president at Essex Investment Management. “We believe this is a huge opportunity.”

An audience member asked the panel to comment on how, if given the opportunity, they would divest the College’s endowment from fossil fuels. Tom Gainey’s answer reflected the complexity of the issue.

“The ability for any asset management firm to do such a thing would undoubtedly be terrifically challenging, whether they’re pooled investments or not,” said Gainey. “We at Pax have a number of funds, and one of them is fossil-fuel free, so we’re engaging ourselves in this discussion internally.”

“A firm like ours – fully engaged in this approach – is having our hands full on this issue,” Gainey continued, “and we’re not saying that it’s impossible to do, but that it’s a process that lends itself to caution, a lot of reflection, a lot of research and collecting of the best minds on the subject.”

The College recently announced it has increased the amount of its endowment specifically directed towards investments that generate long-term social, environmental, and economic value. The value of these specifically directed investments is $25 million as of February 28, 2014, helping to fulfill a pledge made in August 2013. The College also recently announced it has placed $150,000 of its endowment funds under the management of a subgroup of the student-run Socially Responsible Investment Club, which will report its progress annually to the Board of Trustees.

By Stephen Diehl