Kevin Serrao Mathematics Senior Thesis Presentation

“Itô Calculus: Stochastic Integrals and Financial Modeling”

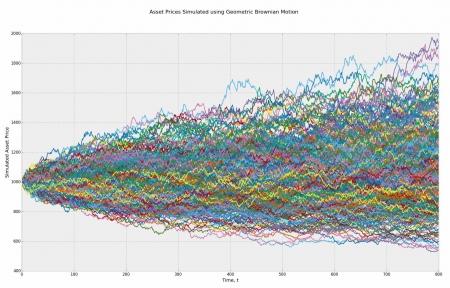

A common model for the value of a stock in the stock market is a Brownian motion. When building a model to predict the future value of such a stock, it becomes necessary to integrate with respect to a Brownian motion, as we will see. The work of Kyoshi Itô showed that it is possible to integrate with respect to a Brownian motion, albeit with a non-intuitive correction term. The talk will discuss the challenges faced when integrating with respect to a Brownian motion, how Itô was able to circumvent those challenges, and the derivation of Itô’s formula, which is the analog of the Fundamental Theorem of Calculus for stochastic integrals.

- Sponsored by:

- Mathematics

Contact Organizer

Olinick, Mike

molinick@middlebury.edu

802.443.5559