Divestment

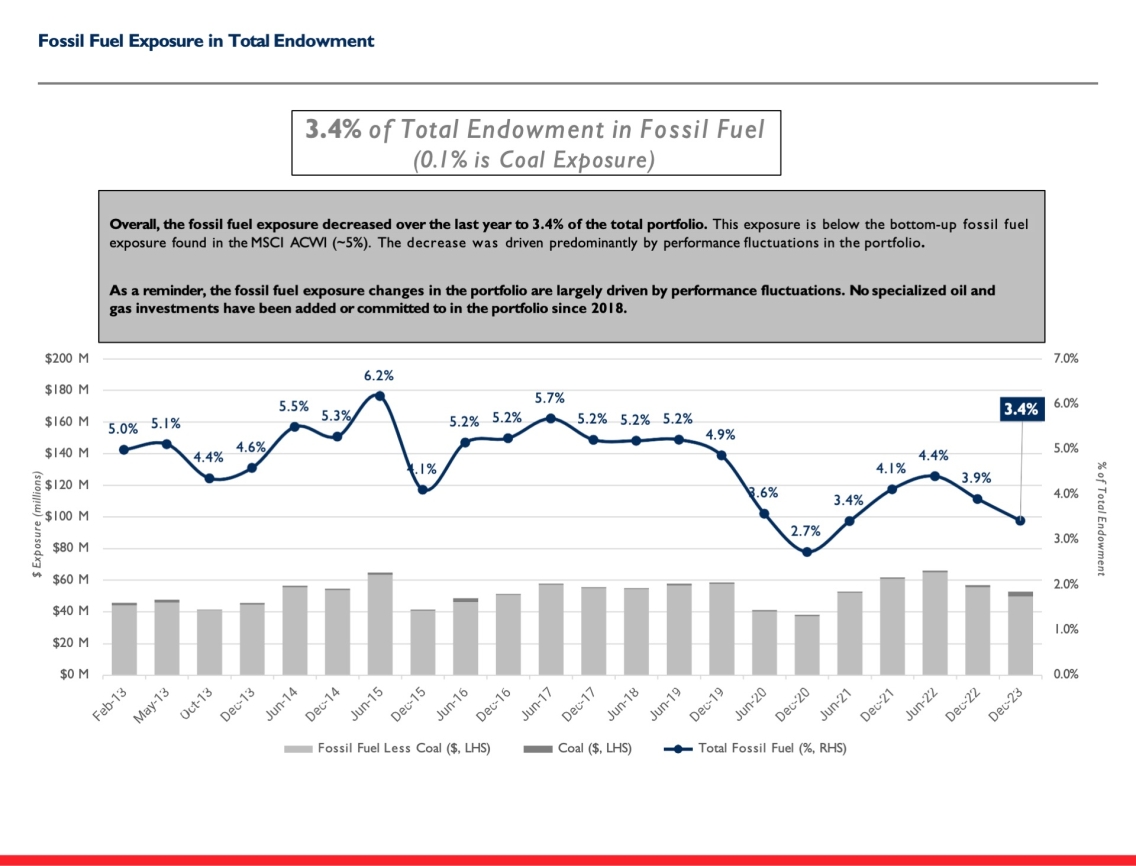

We are well on track to phasing out all direct investments in fossil fuels by 2034 (notes below). The total endowment direct investment in fossil fuel at end of 2023 was 3.4%

Energy2028 commits Middlebury to divesting its endowment of fossil fuel direct investments on the following schedule (we have some long term investment commitments that extend beyond 2028):

- 25 percent by 2024

- 50 percent by 2027

- 100 percent by 2034

Direct investments are: 1) those investments held by specialist managers who maintain an investment focus on fossil fuel companies, and 2) specialist fossil fuel index funds.

Middlebury has defined fossil fuel investment to include those in enterprises whose core business is oil and gas exploration and/or production, coal mining, oil and gas equipment, services and/or pipelines. This is a broader definition than those used by most institutions that have committed to reducing or eliminating fossil fuel investments.

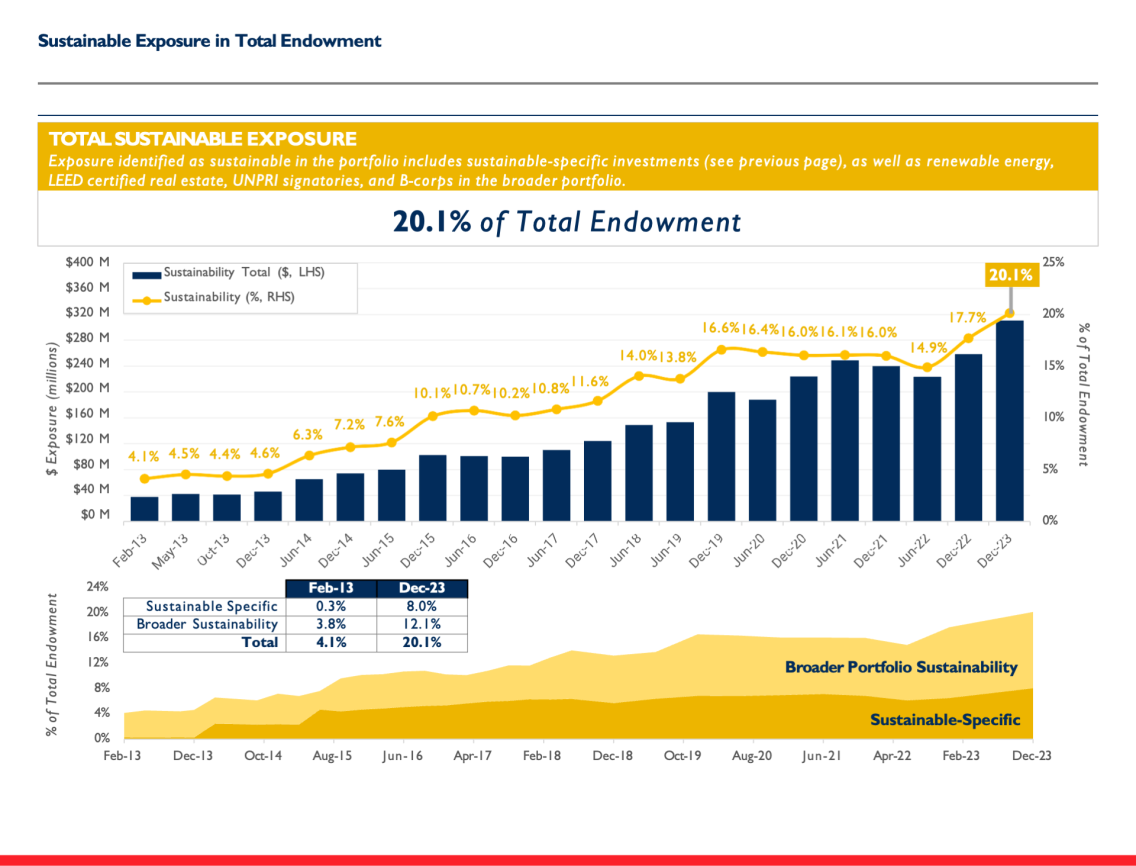

While phasing out of fossil fuel investments, Middlebury has also been increasing it exposure to sustainability related investments including renewable energy, LEED-certified real estate, signatories to the UN Principles for Responsible Investment, and B Corporations. As of 2023 Middlebury’s portfolio sustainability investments were 20% of the portfolio.

Beyond Bretton Woods Initiative

Middlebury took on a big Energy2028 related question: “How does the international financial architecture play a more effective role in addressing climate change and other crises confronting the global community?” and tackled it at a highly successful three-day conference on the Bread Loaf campus in May 2024. It brought 170 people from around the globe together to work on this urgent question.

A video describing the overall event is here. The reports from the three lab sessions are here: