Academic Excellence

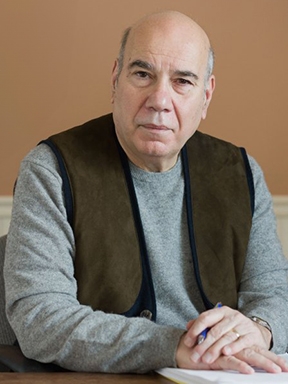

”I’ve always understood that education, as they say, is a teacher on one end of a log and a student on the other end of a log. That’s the core.”

— D. E. Axinn Professor of English and Creative Writing, Jay Parini

Giving

You crushed the MiddWinter Challenge

Thank you for stepping up during the MiddWinter Challenge!

Thanks to our wonderful Middlebury community, this year’s Challenge was a success. Together, we raised over $975,000 from 2,000 donors, earning the full $300,000 in matching funds from our generous challengers.

Your support is making Middlebury stronger, more accessible, and more impactful for students on campus right now. Thank you for showing the world what the Middlebury community can do when we work together.

For Every Future: The Campaign for Middlebury

For Every Future: The Campaign for Middlebury is the largest, most comprehensive effort of its kind in Middlebury history. Now entering its public phase, it will raise $600 million in new investment from alumni, parents, and friends. The institution is already more than halfway toward that goal, with commitments totaling $465 million.

Middlebury also seeks to engage 85 percent of undergraduate alumni through the campaign. 71 percent of undergraduate alumni have already contributed by making gifts, volunteering, or participating in campus, regional, or online events.

Help shape our students’ futures—and Middlebury’s!

When you give to Middlebury, you make an extraordinary education available to exceptional students. You honor people who shaped your life. You strengthen the institution that means so much to you. Through Middlebury, you touch the lives of talented people who can work across intellectual, cultural, and geographic borders and who will make a positive difference in the world.

Support What Matters Most to You

-

Access & Financial Aid

Keep Middlebury accessible.

-

Academic Excellence

Deepen students’ understanding of the world today and tomorrow.

-

Experience

Help students build world-ready and work-ready experience.

See Your Support in Action

The stories of our successes are all grounded in your support. See what a difference you make.

-

-

Capital Projects

Learn More

Fifty-five years after the building first welcomed students of the arts, the Christian A. Johnson Memorial Building has been reborn. The renovated building—one of the most architecturally significant on the campus—reopened for classes this fall, creating a spectacular home for the Studio Art Department and Architectural Studies program, as well as a makerspace open to the community. -

Access

Learn More

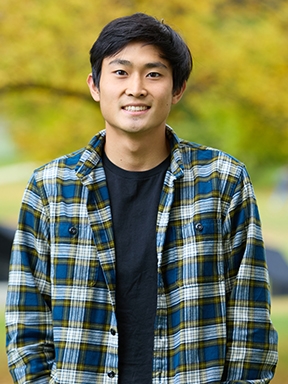

Sophomore Noah Lee’s dream is to become an orthopedic surgeon. “I love working with my hands, and medicine is something I have always been interested in. I want to help people, and being able to work with athletes would be awesome because of how much I can relate to them,” he says. -

Experience

Learn More

“Our full-time assistant position is invaluable to our program says. Not only does it support our day-to-day essential responsibilities, it also exposes our players to confident, capable, and motivated young professionals.”

— Kate Perine Livesay ‘03, Head Women’s Lacrosse Coach