Student Loan Repayment Restart

The Office of Student Financial Services is providing these resources to help you navigate the student loan repayment restart process and prepare for your student loan payments.

Federal student loan payments of principal and interest that were paused in March 2020 as part of the Coronavirus Aid, Relief and Economic Security (CARES) Act are set to return to repayment after August 31, 2023.

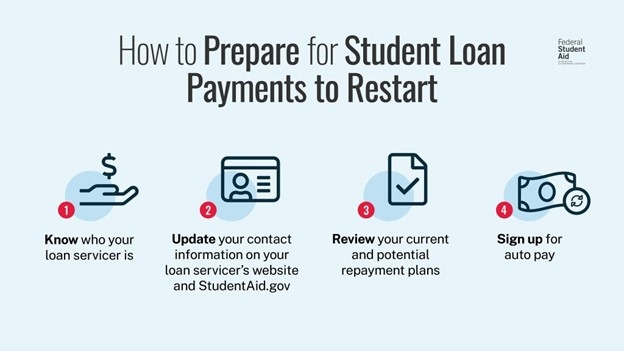

To find out who your loan servicer is, log into Federal Student Aid with your FSA ID. Once you are logged into your account, update your contact information, including email, phone number, and mailing address. Be sure to update your contact information directly on your Loan Servicer’s website also. When you review and select your repayment plan, consider the new SAVE plan. Signing up for auto pay is helpful to ensure your monthly payments are made on time.

Federal Student Loan Repayment Resources

Resources from Federal Student Aid (FSA):

Federal Student Aid Prepare for Student Loan Payments to Restart - For borrowers that had been paying prior to the COVID-19 payment pause and will be restarting their payments

Federal Student Aid Repaying Student Loans for the First Time - For borrowers that will be entering repayment for the first time since the COVID-19 payment pause began

Identify Your Federal Student Loan Servicer

Resources from the National Association of Student Financial Aid Administrators (NASFAA):

Student Loan Repayment Toolkit

How to Prepare for Successful Student Loan Repayment

How to Pick the Right Repayment Plan

Resources from iGrad, Middlebury’s Financial Literacy Partner:

Recorded Webinar on Preparing for Student Loan Repayment in 2023

Navigating the Return of Federal Student Loan Payments in 2023

Middlebury College Loan & Perkins Loan Repayment

In accordance with the U.S. Department of Education’s announcement to extend the pause on student loan repayment, interest, and collections, Middlebury agreed to extend its pause. Interest and payments will resume in September 2023, along with loan collection activities.

If you borrowed Middlebury College Loans or Middlebury Perkins Loans, ECSI is your servicer and can assist you with all aspects of your loan and payments, including help starting or returning to repayment.

Information on your repayment options, making payments, understanding your billing statement, and help can be found at Student Loan Accounts.

New to ECSI? Follow these instructions for Creating a Profile.