What are the Key Benefits of an HSA?

We encourage all benefit eligible employees to take a few minutes and consider the advantages that come with having a Health Savings Account (HSA) - some even call it the triple tax advantage.

What is an HSA?

An HSA is an individual account you can open, add pre-tax money to, and spend on eligible health care expenses. The HSA is only available to employees who have elected the Silver Panther high deductible health plan (HDHP).

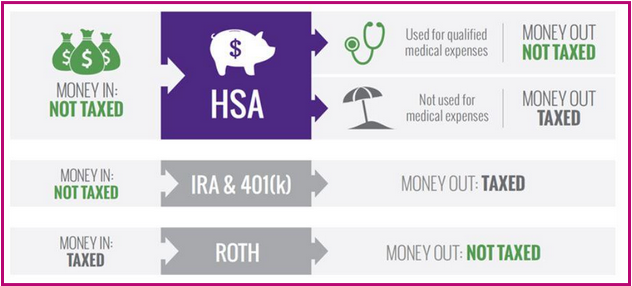

What is the “triple tax advantage”?

- Contributions are tax deductible (federal) so they reduce your taxable income.

- Any earnings on those contributions are tax-free.

- When you withdraw for qualified out of pocket expenses, the withdrawals are also tax free.

What other advantages are there to an HSA?

- Any balance you have in the account at the end of the year rolls over and can be used in the future - the money you put aside in your HSA will never expire.

- You own the account and control how you spend your money on eligible expenses.

- You may use the funds for yourself, your spouse, or any dependents you can claim on your tax return (important note: domestic partners will not qualify).

- The college provides participants in our HDHPs contributions into their accounts - extra money!

- As you grow your balance, it can be invested in mutual funds.

- Your HSA account can be considered another item in your portfolio of retirement planning. Many who begin saving early (when they may have fewer healthcare expenses) find that as they age their HSA balance has grown to support their medical expenses later in life (when they may be facing more healthcare expenses).

What are “qualified medical expenses” or QME?

- QMEs are out-of-pocket medical, dental, prescription and vision expenses as determined by the IRS if they cover the diagnosis, treatment or prevention of disease and the costs for treatments.

- Check out this more extensive list on Health Equity’s website.

How much can I put into an HSA in 2024?

|

Individual Coverage |

2 Person or Family Coverage |

|

|

Under age 55 |

$4,150 |

$8,300 |

|

Age 55 and over |

$5,150 |

$9,300 |

|

★ IMPORTANT! Depending on the health plan you choose in 2024, the college will also contribute money into your HSA. Take a look at page 15 in your 2024 Benefit Guide to see the amount the college would contribute based on the plan you are enrolling in, and then determine how much you would like to contribute. |

||

Where can I learn more about HSAs?

- Health Equity: How an HSA Works

- Bank of America: Top 5 Reasons to use a HSA

- Charles Schwab: Is an HSA a Good Deal?

- HealthInsurance.org: How does a health savings account (HSA) work?

Questions?

Your Benefits Team is here to support you! We are available Monday through Friday from 8:15am - 5:00pm EST.

- Email us at benefits@gmhec.org

- Please note: We utilize Team Dynamix (TDX) to follow up on your inquiries. After emailing us, please be on the lookout for our email response from “Support” with an associated email address of tdx-mailer@gmhec.org.

- Call us at 802-443-5485

The Green Mountain Higher Education Consortium (GMHEC) is a collaborative endeavor of Champlain College, Middlebury College and Saint Michael’s College. Your Benefits Team is your resource for benefits enrollment, ongoing questions, benefits support throughout the year, and well-being programming.